Ask most HVAC business owners if they plan to sell someday, and the answer is almost always “yes.”

Ask if they’re ready to sell—and the answer changes.

The reality is this: while private equity interest in HVAC companies has never been higher, most businesses in the space are not exit-ready. Not because they aren’t profitable—but because they aren’t prepared for scrutiny.

And when preparation lags, valuations suffer.

The HVAC M&A Boom Is Real—but Buyers Are Selective

Private equity firms and strategic buyers are aggressively acquiring HVAC, plumbing, and mechanical services companies. The appeal is obvious:

- Recurring service revenue

- Fragmented markets

- Strong local brands

- Predictable cash flow

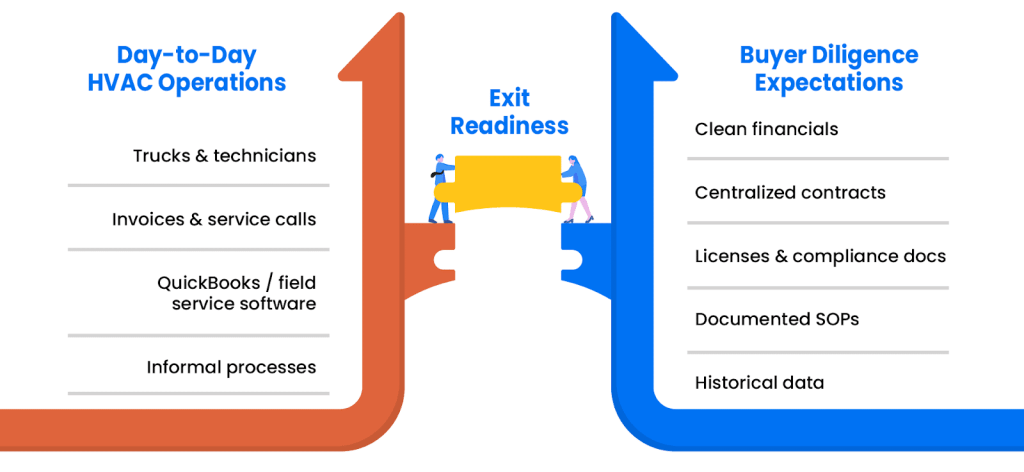

But buyers aren’t just buying trucks and technicians. They’re buying process, predictability, and proof.

If your business can’t produce clean, organized documentation quickly, that interest can fade fast.

Profitability Isn’t Enough Anymore

Many HVAC owners assume strong EBITDA will carry the deal.

It won’t.

Buyers want to understand:

- How the business actually operates

- Whether growth is repeatable

- If risks are documented—or hidden

That means diligence goes far beyond financials.

Where Most HVAC Businesses Fall Apart in Diligence

Here’s where deals slow down—or quietly die.

1. Disorganized Financial and Operational Records

- Financials scattered across systems

- Inconsistent reporting

- Missing historical data

Buyers don’t want explanations. They want clarity.

2. Licensing, Permits, and Compliance Gaps

HVAC businesses are heavily regulated, often across multiple jurisdictions.

Common issues include:

- Expired or missing licenses

- Incomplete insurance records

- OSHA or safety documentation gaps

- Environmental compliance issues (refrigerants, disposal)

One missing document can delay—or derail—a transaction.

3. Customer and Vendor Contracts Aren’t Centralized

Many owners rely on verbal agreements or poorly organized contracts.

Buyers want visibility into:

- Contract terms

- Renewal risks

- Customer concentration

- Vendor dependencies

If contracts can’t be produced quickly, trust erodes.

4. Key Knowledge Lives in the Owner’s Head

This is one of the biggest red flags.

If:

- Only the owner knows pricing logic

- Only one person manages vendor relationships

- SOPs are informal or undocumented

Buyers see risk—and discount accordingly.

Exit-Ready Doesn’t Mean “For Sale Tomorrow”

Being exit-ready doesn’t mean you’re actively selling. It means your business is run like it could be sold at any time.

Exit-ready HVAC businesses typically have:

- Clean, well-organized financials

- Centralized documentation

- Clear operational processes

- Compliance documentation readily available

- A professional approach to data sharing

Ironically, these businesses also perform better day-to-day—even if a sale never happens.

The Role of Secure Document Organization in Exit Readiness

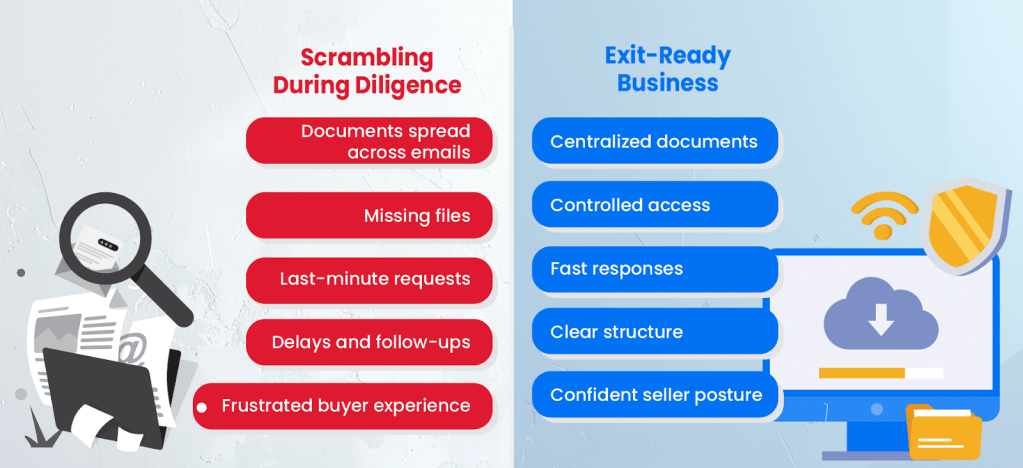

When buyers engage, they expect speed.

That means being able to securely share:

- Financial statements

- Tax records

- Customer contracts

- Licensing and permits

- Insurance certificates

- Employee certifications

- Fleet and equipment records

Scrambling to gather documents during diligence signals unpreparedness—and weakens negotiating leverage.

Exit Readiness Is a Valuation Strategy

The difference between a smooth process and a painful one often comes down to preparation.

Exit-ready HVAC businesses:

- Close faster

- Command stronger multiples

- Face fewer surprises

- Maintain leverage throughout negotiations

The best time to get organized isn’t when a buyer shows up. It’s well before.

Final Thought

Most HVAC owners don’t lose value because their business isn’t good enough.

They lose value because they waited too long to prepare.

Exit readiness isn’t about selling—it’s about optionality. And in today’s HVAC M&A market, optionality is power.