M&A has always been about speed, precision, and trust. But the way deals get done is changing — and fast. Artificial intelligence and automation are no longer fringe tools; they’re becoming the backbone of modern deal-making.

The firms that harness them are closing faster, uncovering risks sooner, and setting the pace for everyone else. The ones that don’t? They’ll be negotiating from behind.

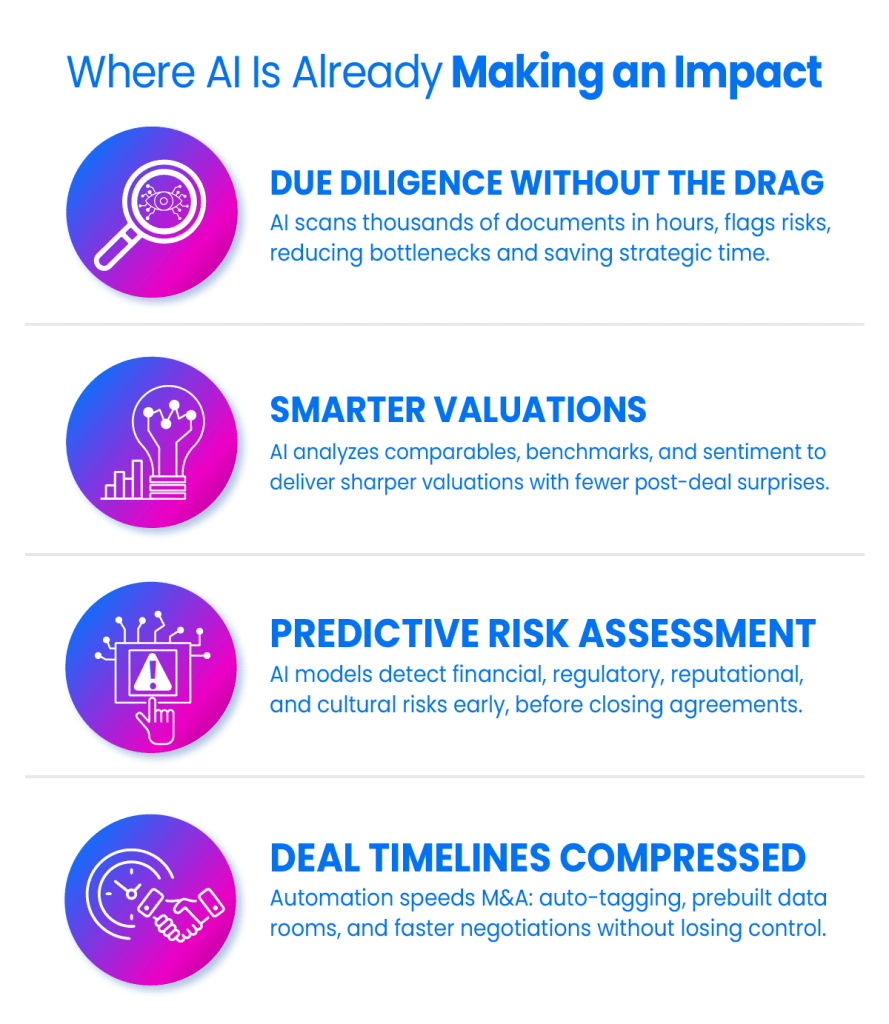

Where AI Is Already Making an Impact

1. Due Diligence Without the Drag

Traditionally, diligence has been the deal-killer — weeks or months of combing through contracts, financials, compliance documents, and emails. AI-powered tools now scan thousands of pages in hours, flagging anomalies, missing clauses, or compliance risks with near-perfect accuracy. That means fewer bottlenecks, and more time spent on strategy instead of paperwork.

2. Smarter Valuations

AI isn’t just crunching numbers; it’s analyzing patterns. By pulling data from market comparables, industry benchmarks, and even sentiment analysis from earnings calls, AI can help refine valuations and provide a clearer picture of upside potential or hidden liabilities. That leads to sharper negotiations and fewer surprises post-close.

3. Predictive Risk Assessment

AI models are now being trained to identify red flags earlier — not just financial risk, but reputational, regulatory, and even cultural risks. Imagine knowing, before the LOI is signed, whether a target company’s compliance practices will survive regulatory scrutiny or whether cultural misalignment could derail integration.

4. Deal Timelines Compressed

Automation is eliminating the lag time that used to define M&A. From auto-tagging documents to setting up data rooms with prebuilt folder structures, deals that once dragged can now move at high velocity — without sacrificing control.

What’s Next: The 3–5 Year Outlook

- Fully Automated First-Pass Diligence: Expect AI to handle the first 70–80% of diligence review, with human experts only stepping in for context and judgment calls.

- AI-Driven Negotiation Support: Algorithms will model negotiation scenarios, forecasting how deal terms are likely to play out under different market conditions.

- Seamless Cross-Border Transactions: Translation, compliance alignment, and jurisdiction-specific insights delivered instantly by AI, making global M&A less risky and more accessible.

- Continuous Monitoring Post-Close: Automation won’t stop at signing — it will monitor integration milestones, compliance requirements, and performance benchmarks in real time.

The Risks of Over-Reliance

But let’s be clear: AI isn’t a magic wand. It has blind spots.

- Context Blindness: An algorithm can spot anomalies, but it can’t always interpret the “why.” Human judgment is still non-negotiable.

- Data Bias: AI is only as good as the data it’s trained on. Biased or incomplete data leads to skewed outcomes — and costly mistakes.

- False Confidence: The danger isn’t just AI being wrong; it’s humans assuming it’s always right. Overconfidence in automation can amplify risks rather than reduce them.

That’s why the future of deal-making isn’t AI versus humans. It’s AI plus humans. Machines do the heavy lifting; humans make the judgment calls.

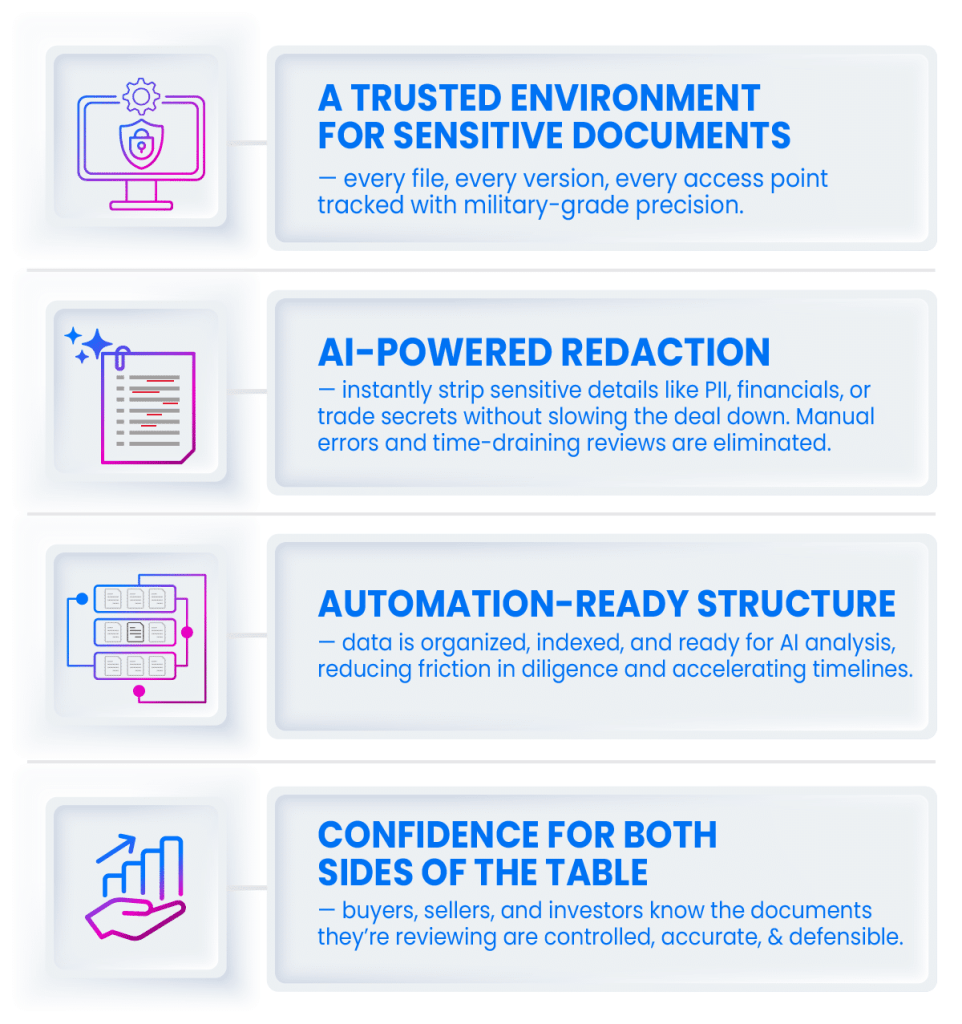

Where ShareVault Fits In

AI and automation only work if the data is clean, secure, and structured. Without that foundation, the promise of faster, smarter deals collapses. That’s where ShareVault makes the difference.

The future of M&A belongs to firms that move at AI speed while protecting trust at every step. ShareVault is the bridge — where cutting-edge automation meets uncompromising security.

Because in the next era of deal-making, it’s not just about who has the data. It’s about who can protect it, present it, and share it smarter.