After a protracted lull, the global initial public offering (IPO) market is staging a comeback. The drought of listings in 2022–2023, driven largely by macro volatility, high interest rates, and investor risk aversion, is giving way to renewed optimism.

Here’s how the market is shaping up:

Recent Performance & Key Drivers

- In the U.S., the first half of 2025 saw about 165 IPOs, marking a ~76% increase over the same period in 2024 (Stout).

- The rebound is broad-based: technology, industrials, and energy segments are among the leaders (Stout).

- SPACs are re-emerging, accounting for nearly 37% of U.S. IPOs in H1 2025 (Stout).

- Biotech, digital health, and some pharma subsectors remain relatively quiet, reflecting persistent investor caution (Stout).

- On the global front, India is seeing significant momentum: over 240 large and mid-sized firms have already raised ~$10.5 B in 2025, and the final quarter could deliver up to $8 B in new listings (Reuters).

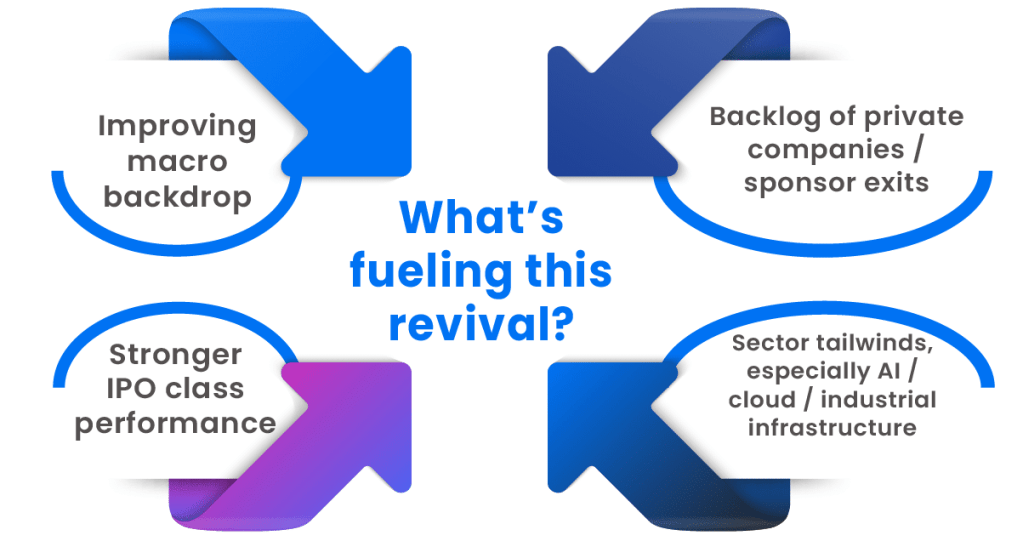

What’s fueling this revival?

- Improving macro backdrop

Inflation pressures have begun to ease, and markets are pricing in rate cuts, making equity more attractive relative to debt (EY). - Stronger IPO class performance

The IPO class of 2024 generally delivered solid aftermarket returns, boosting investor confidence for new issuers (EY). - Backlog of private companies / sponsor exits

Many high-growth private companies and PE/VC-backed firms need exit paths, pushing some toward public listings (Morgan Stanley). - Sector tailwinds, especially AI / cloud / industrial infrastructure

Tech, AI, cloud infrastructure, and industrial enterprises tied to reshoring or energy investments are drawing investor interest (Stout).

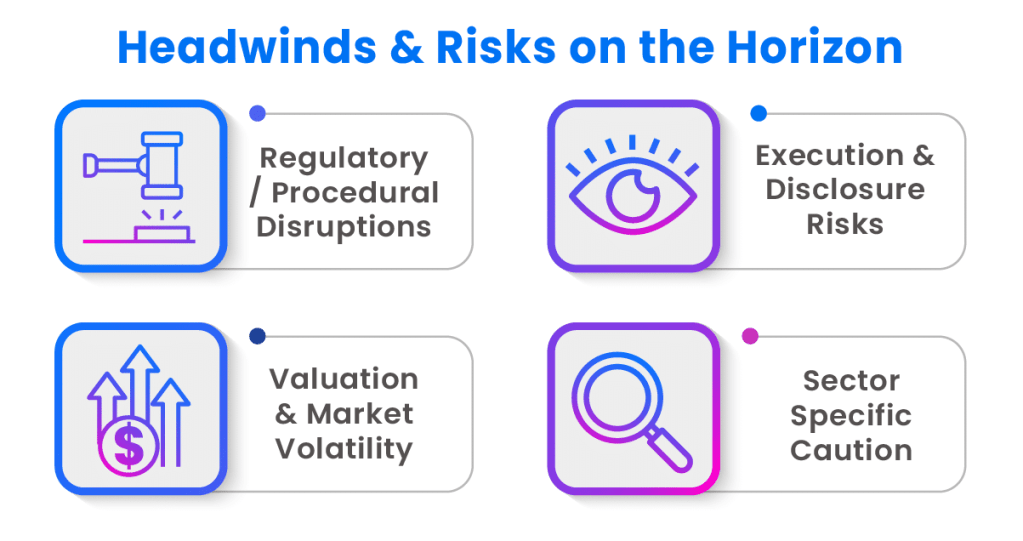

Headwinds & Risks on the Horizon

Regulatory / Procedural Disruptions

- The looming U.S. government shutdown threatens to disrupt IPO approvals, as the SEC may only operate minimally during a funding lapse.

- In India, regulators are proposing rule changes to ease listing burdens, such as allowing large companies to issue a smaller portion of shares in their IPOs to reduce dilution.

Valuation & Market Volatility

- While valuations have rebounded, there is still sensitivity to interest rate moves, geopolitical tensions, and macro shocks (Morgan Stanley).

- Overvaluation risk is real, especially for high-growth names lacking a clear path to profitability.

Execution & Disclosure Risks

- As private companies transition to public markets, they must build stronger governance, financial controls, audit readiness, and risk disclosure frameworks. Some may underestimate the cost and complexity (Deloitte).

- Customer concentration, contract renewal risk, and dependency on a few large clients are common red flags in IPO disclosures.

Sector-Specific Caution

- Biotech and life sciences still face investor wariness due to regulatory uncertainty, long development cycles, and capital intensity (Stout).

- Consumer-oriented companies may see more scrutiny in a macro environment that favors industrial and tech themes (Stout).

IPOs to Watch & Notable Performers

A few marquee names highlight the renewed vigor in 2025:

- CoreWeave: A cloud infrastructure / GPU platform, which delivered strong growth and market interest (AlphaSense).

- Chime, Klarna, Stripe – fintech names expected to make waves if they pursue U.S. listings (Morningstar).

- Ethos Technologies: Filed for a U.S. IPO, showcasing strength in the insurtech/insurance space (Reuters).

- In India, major upcoming IPOs include Tata Capital, LG Electronics India, and others that could push the domestic market into record territory (Reuters).

Outlook & Strategic Takeaways

Outlook

- It’s unlikely 2025 will eclipse the IPO frenzy of 2021, but deal flow and volumes are expected to comfortably exceed the muted levels of 2022–2024 (EY).

- The second half of 2025 and into 2026 could be more active, especially if rates ease and macro pressures stabilize (Morgan Stanley).

- The “best-fit” IPOs will be those with strong fundamentals, credible growth paths, and differentiated narratives rather than those chasing market momentum.

For Companies Preparing to Go Public

- Start early with governance, audit readiness, and financial controls – the transition from private to public is more demanding than many realize.

- Build a compelling equity story – clearly articulate unit economics, scalable growth, margin expansion paths, and defensibility.

- Be flexible with timing – market windows open and close rapidly. Prepare alternate paths (e.g., delay, hybrid listing, PIPE).

- Reduce concentration risk & diversify customers – address any overreliance on a handful of clients.

- Engage high-quality underwriters and advisors – their relationships and guidance can make or break execution.

For Investors & Market Observers

- Be discerning: with more IPOs coming, differentiation matters. Avoid “hype-only” names without fundamentals.

- Focus on sector tailwinds (AI/infra, industrial, energy) but don’t ignore risks.

- Monitor regulatory shifts (especially the SEC in the U.S. and equivalent bodies in emerging markets) that might affect IPO pipelines.