In M&A, every deal starts with one invisible variable: trust.

Before numbers are shared, before valuations are debated, before the Letter of Intent (LOI) hits the table—buyers are asking a silent question:

“Can I trust this seller?”

The answer often determines how fast the deal moves, how detailed the due diligence becomes, and whether negotiations feel collaborative or combative.

Let’s look at how sellers can build buyer confidence early—long before the LOI is signed—and how modern data room practices can make all the difference.

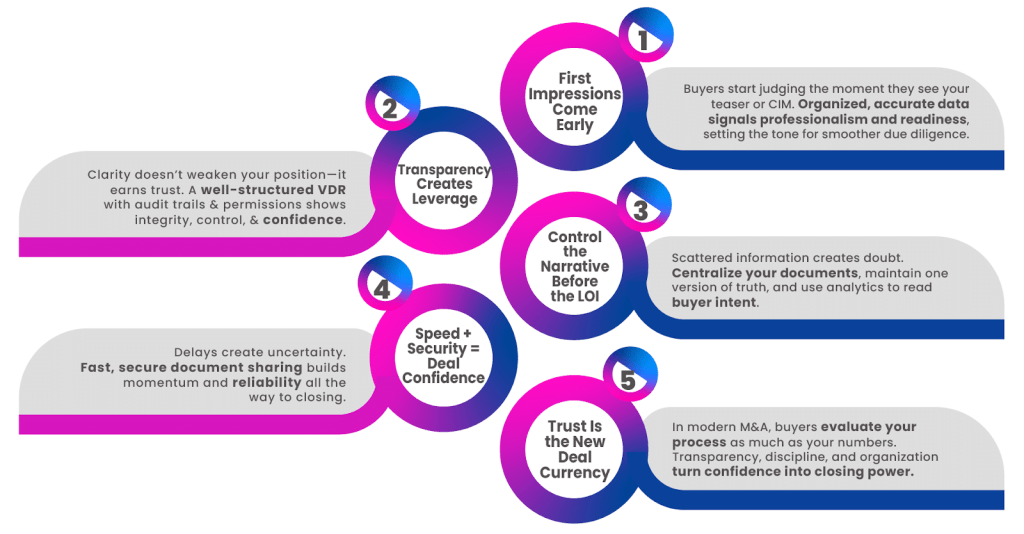

1. First Impressions Happen Earlier Than You Think

Buyers start forming opinions the moment they receive a teaser or CIM (Confidential Information Memorandum). A disorganized presentation, missing files, or outdated metrics sets off alarms before any meeting begins.

By contrast, sellers who prepare well-structured, accurate documentation and host it in a secure virtual data room signal professionalism from the start. It tells buyers:

- “We know what you’ll need.”

- “We’ve done our homework.”

- “You can rely on the integrity of our data.”

That confidence translates directly into smoother, faster conversations once due diligence begins.

2. Transparency Builds Negotiation Power

It’s counterintuitive—but transparency doesn’t weaken your position. It strengthens it.

When buyers see a clear audit trail, consistent financials, and organized folders, they feel less need to “dig.” Instead of questioning accuracy, they focus on valuation and fit.

In other words: transparency reduces friction.

A well-structured data room with version control, permission settings, and analytics doesn’t just manage access—it demonstrates integrity. Buyers can see what they’re supposed to see, and sellers can track exactly who’s viewing what.

That’s not just security—it’s strategy.

3. Control the Narrative Before the LOI

Deals fall apart when the story feels inconsistent. Data scattered across emails, cloud drives, or multiple systems creates confusion—and confusion breeds skepticism.

Sellers who centralize documentation in a single, secure platform ensure that everyone’s working from the same version of the truth. With a well-organized index, logical naming conventions, and custom permissions for different buyer groups, you project order and credibility.

And because analytics reveal who’s engaging with what, you gain valuable intelligence:

- Which buyers are spending time on your financial model?

- Who’s reviewing legal docs repeatedly?

- Who hasn’t logged in at all?

These insights help you gauge real interest and tailor follow-up conversations accordingly.

4. Speed + Security = Confidence

Time kills deals. Delays in document delivery or access create uncertainty.

That’s why top-performing deal teams invest in virtual data rooms (VDRs) that streamline the early stages: instant access, rapid permissioning, and the ability to redact sensitive content without holding up the process.

By the time you reach the LOI, buyers have experienced a process that feels professional, efficient, and trustworthy. That feeling often carries through to closing.

5. Trust Is the New Deal Currency

In today’s competitive market, buyers aren’t just evaluating numbers—they’re evaluating you.

A seller who prioritizes security, organization, and transparency creates momentum. The right data handling signals confidence, discipline, and respect for the process—qualities buyers equate with lower risk.

In short:

Trust accelerates deals.

Secure transparency wins them.

Ready to Build Buyer Confidence From Day One?

ShareVault helps deal teams present, protect, and control their information with unmatched precision and insight. From pre-LOI readiness to post-close integration, our virtual data room empowers you to share smarter—and close faster.