Over the past two decades, we’ve seen biotech startups evolve from niche players into billion-dollar unicorns, pharma companies shift from in-house R&D to external partnerships, and investors pour capital into everything from gene editing to AI-designed drugs.

The question for executives, investors, and dealmakers is: What’s next?

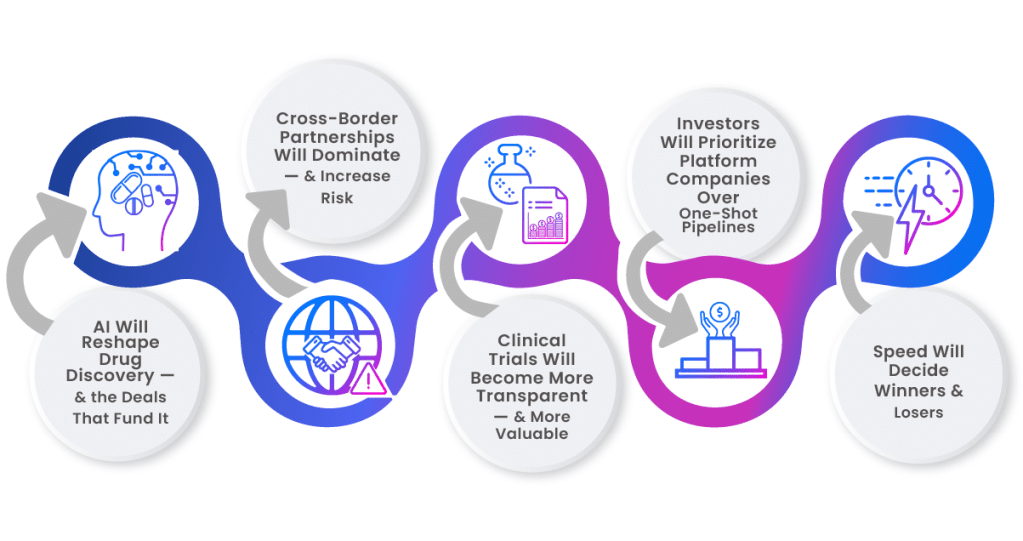

As we look toward 2030, here are five predictions for how pharma-biotech partnerships will evolve — and what leaders can do today to prepare.

1. AI Will Reshape Drug Discovery — and the Deals That Fund It

AI-driven drug design is already moving from science fiction to reality. By 2030, we’ll see pharma and biotech partnerships where the algorithm is as valuable as the molecule.

- Shift in valuation: Investors won’t just value IP on compounds and trials, but also on proprietary datasets and AI platforms.

- New licensing structures: Instead of traditional milestone payments, expect deals structured around data sharing rights and algorithm improvements.

- Implication: Companies that can prove secure, organized data sharing will win more lucrative deals.

2. Cross-Border Partnerships Will Dominate — and Increase Risk

The best ideas won’t be confined to Boston, San Diego, or Basel. Partnerships will increasingly span China, India, Europe, and emerging biotech hubs in Africa and South America.

- More collaboration, more complexity: Regulatory, cultural, and data-protection frameworks will collide.

- IP leakage risk: Sensitive trial data and proprietary tech will be harder to safeguard across jurisdictions.

- Implication: Dealmakers will require controlled digital environments where global teams can collaborate without fear of compromise.

3. Clinical Trials Will Become More Transparent — and More Valuable

By 2030, regulators and the public will demand near real-time visibility into trial data. Partnerships will need to share results with investors, regulators, and partners faster than ever.

- Transparency as a trust signal: Companies that can share secure, verifiable data will build stronger reputations.

- Trial data as a currency: Trial results will drive valuation just as much as IP portfolios.

- Implication: Organizing data in a secure, auditable system will be essential — sloppy trial data management could kill a deal.

4. Investors Will Prioritize Platform Companies Over One-Shot Pipelines

Instead of betting on single molecules, investors are backing platforms that can spin off dozens of drug candidates.

- Platform-first deals: Partnerships will focus on scalability, not one-hit wonders.

- Due diligence shifts: Buyers will want proof of reproducibility, scalability, and underlying IP rights.

- Implication: Biotech startups will need to present well-structured digital portfolios that highlight platform strength, not just one compound.

5. Speed Will Decide Winners and Losers

By 2030, the pace of deals will accelerate. Pharma giants won’t wait years to evaluate a biotech partner. Decisions will be made in months, sometimes weeks.

- Compressed due diligence: Buyers will expect instant access to clean, organized data.

- Competitive pressure: Multiple suitors mean sellers must control the data room to maintain leverage.

- Implication: The companies that prepare early — structuring, securing, and presenting their data proactively — will command higher valuations.

Where ShareVault Fits In

The future of pharma-biotech partnerships won’t just hinge on science. It will hinge on trust.

- A trusted environment for sensitive documents: Every file, version, and access point tracked.

- Automation-ready structure: Making it easy to layer AI on top of clean, well-organized data.

- Confidence for both sides of the table: Buyers, sellers, and investors know the information they’re reviewing is controlled, accurate, and defensible.

In the next decade of deal-making, the winners won’t just be the companies with breakthrough science. They’ll be the ones who can share it smarter.