Table of Contents

General Data Room FAQs

VDRs And The Deal Process

Security & Compliance FAQs

Advanced Features & Competitive Edge

Post-Deal FAQs

Mergers and acquisitions are some of the most complex, high-stakes transactions in the business world. Billions of dollars can hinge on a single piece of overlooked information. That’s why Virtual Data Rooms (VDRs) have become the standard infrastructure for modern dealmaking.

In the past, due diligence involved locked physical rooms, stacks of paper files, and in-person review. Today, secure digital platforms — Virtual Data Rooms — make it possible to manage massive volumes of sensitive documents with speed, control, and transparency.

This guide answers the most common — and most important — questions dealmakers ask about VDRs in M&A. Whether you’re a first-time seller, a private equity associate, or a seasoned banker, you’ll find practical insights here to help you run smarter, faster, and more secure transactions.

General VDR FAQs

Q: What exactly is a Virtual Data Room in M&A?

A Virtual Data Room (VDR) is a secure, cloud-based repository where companies store and share sensitive documents during mergers, acquisitions, fundraising, or other confidential transactions. Unlike consumer file-sharing tools, a VDR is purpose-built for high-stakes deals — providing encryption, access controls, audit trails, and deal-focused workflows.

Think of it as a mission-critical control room for due diligence. Every contract, financial statement, IP filing, or HR record that matters to a buyer is housed here, under strict security protocols.

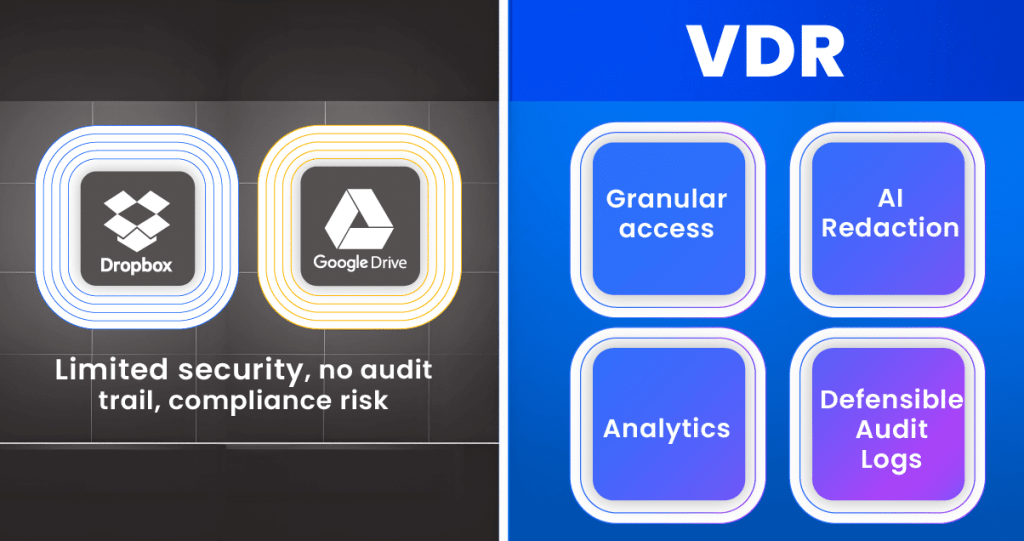

Q: Why do companies use VDRs instead of Dropbox or Google Drive?

Convenience tools like Dropbox or Google Drive are designed for everyday file sharing. They’re not built to handle the security, compliance, and audit demands of M&A. With billions on the line, a generic file-sharing link is simply too risky.

A VDR provides:

- Granular permissions: Define who can view, print, or download each document.

- Audit trails: Track every click and view for defensibility.

- Watermarking: Deter leaks by stamping user IDs on every page.

- Redaction: Remove sensitive details (e.g., SSNs, trade secrets) automatically with AI.

- Deal-specific workflows: Q&A tracking, request lists, and buyer analytics.

For investment bankers, private equity firms, and corporate sellers, a VDR isn’t optional — it’s the difference between a controlled process and a potential disaster.

Q: Who uses VDRs in the M&A process?

- Sellers: Corporate development teams, CFOs, or business owners preparing for sale.

- Buyers: Investment bankers, PE firms, strategic acquirers, legal and financial advisors.

- Advisors: Lawyers, accountants, consultants, regulators, and compliance experts.

Every serious stakeholder in a deal touches the VDR. It’s the single source of truth.

VDRs and the Deal Process

Q: How does a VDR accelerate due diligence?

Due diligence is traditionally one of the most time-consuming phases of a deal. Without structured document sharing, weeks can be wasted on version confusion, duplicate requests, and disorganized files.

A VDR accelerates this by:

- Centralizing all documents in one secure, searchable repository.

- Automating indexing and tagging, so buyers can find what they need instantly.

- Enabling real-time collaboration between multiple buyer teams across geographies.

- Providing analytics, so sellers can see which sections buyers are focused on and anticipate negotiation points.

Example: A mid-market private equity firm reported cutting diligence time by 30% using a VDR with advanced indexing and redaction tools. That saved weeks on the timeline — a decisive advantage in competitive auctions.

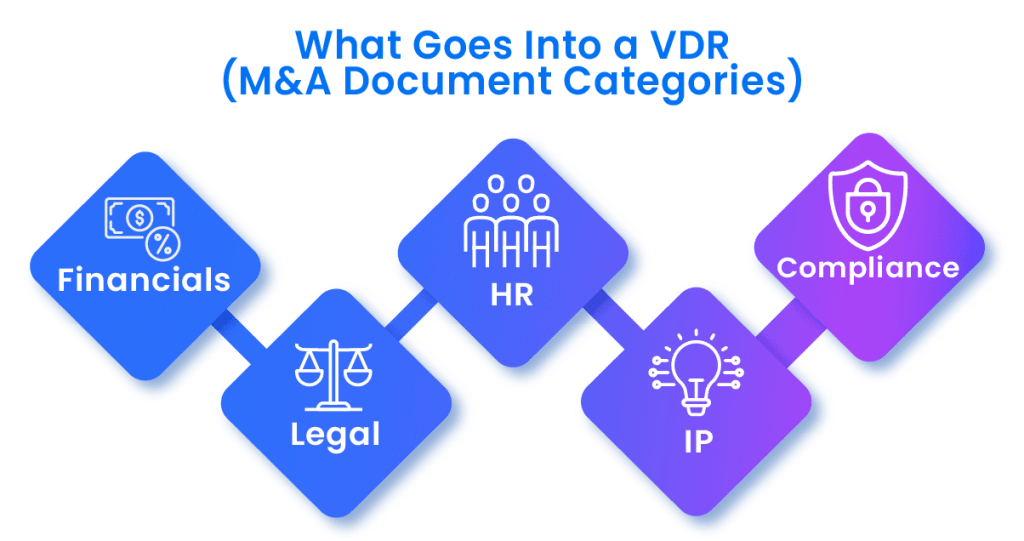

Q: What documents belong in a VDR during M&A?

Every deal is unique, but common categories include:

- Corporate records (charter, bylaws, board minutes)

- Financials (audited statements, forecasts, tax returns)

- Legal (contracts, litigation, licenses)

- Human resources (employee agreements, benefits, org charts)

- Intellectual property (patents, copyrights, trademarks)

- Commercial (customer/supplier agreements, sales pipeline)

- Compliance (permits, regulatory filings, data privacy policies)

Organizing these files upfront is critical. A disorganized data room signals sloppy preparation and can erode buyer confidence.

Q: How long should a VDR stay open after a deal closes?

Best practice is 30–90 days post-closing. This window supports integration, earnouts, or transition issues. After that, files should be archived securely or migrated to long-term corporate systems.

Security & Compliance FAQs

Q: How secure is a Virtual Data Room?

Modern VDRs use bank-grade security measures:

- AES-256 encryption for data at rest and in transit.

- Multi-factor authentication to block unauthorized access.

- Granular permissions to control who sees what.

- Dynamic watermarking to deter unauthorized sharing.

- Comprehensive audit logs to track every action.

For deals under regulatory scrutiny, these features aren’t nice-to-haves — they’re non-negotiable.

Q: Why is redaction essential in M&A VDRs?

Due diligence often involves exposing sensitive data — employee records, customer lists, proprietary formulas. Not all buyers should see all details.

That’s where AI-powered redaction comes in. ShareVault, for example, lets sellers automatically remove personally identifiable information (PII) or confidential clauses without slowing down review. This prevents compliance violations while keeping the deal moving.

Example: In a biotech licensing deal, sensitive clinical trial patient data had to be redacted before sharing. AI redaction saved weeks of manual work, keeping the transaction on track.

Q: Do VDRs comply with regulations like GDPR, HIPAA, or SEC rules?

Yes — enterprise-grade VDRs are designed for compliance-heavy industries. They include features like data residency options, consent controls, and immutable audit trails to satisfy regulators in finance, healthcare, life sciences, and beyond.

Advanced Features & Competitive Edge

Q: What analytics can a VDR provide to sellers?

VDR analytics track who viewed what, when, and for how long. This intelligence can reveal:

- Which buyers are most engaged.

- What sections raise red flags (e.g., repeated views of litigation files).

- Where buyers spend little time (signaling less concern).

For sellers, this is like having a window into the buyer’s mind. It helps anticipate questions, tailor negotiations, and even prioritize bidders in a competitive process.

Q: Can a VDR be tailored to specific industries?

Absolutely. For example:

- Life Sciences: Manage licensing, clinical trial data, FDA submissions.

- Financial Services: Speed portfolio company exits, regulatory audits.

- Energy & Oil/Gas: Handle compliance-heavy exploration rights and environmental reports.

- Real Estate: Centralize leases, title deeds, property appraisals.

- Technology: Secure code repositories, IP, and vendor contracts.

Industry specialization matters. A biotech firm has different diligence needs than a real estate developer — and the right VDR adapts accordingly.

Q: How is AI transforming VDRs in M&A?

Artificial intelligence is no longer futuristic — it’s already embedded in modern VDRs.

- Smart document classification: AI auto-sorts uploaded files.

- AI-powered redaction: Sensitive data is automatically masked.

- Predictive analytics: Highlight buyer intent and deal risks.

- Automated workflows: Accelerate Q&A management and request tracking.

The result? Faster deals, reduced human error, and stronger defensibility.

Post-Deal FAQs

Q: Can a VDR be used after the deal closes?

Yes. Many firms extend usage for:

- Integration planning (IT, HR, operations).

- Earnouts or contingent payment monitoring.

- Board reporting and investor communications.

- Regulatory audits or SEC compliance.

A VDR doesn’t just get you to closing — it supports smooth post-merger execution.

Q: What happens to the data room after integration?

Most companies archive the VDR into secure, long-term storage or migrate the files to corporate systems. Some continue to use the VDR as an ongoing secure communication platform for board members, auditors, or regulators.

Final Thoughts

Virtual Data Rooms have evolved from simple file storage into strategic enablers of M&A success. They provide the security, speed, and intelligence that dealmakers need to compete in today’s fast-moving markets.

The firms that win aren’t just those with the best strategy — they’re the ones who execute faster, safer, and smarter. A powerful VDR makes that possible.

At ShareVault, we believe the future of M&A belongs to dealmakers who combine technology with trust. That’s why we’ve built tools like AI-powered redaction, advanced analytics, and compliance-ready infrastructure — so your next deal doesn’t just close, it closes smarter.

Because in M&A, every detail matters. And the best.